Everything about Lamina Loans

Wiki Article

The Greatest Guide To Lamina Loans

Table of ContentsThe Definitive Guide for Lamina LoansLamina Loans Can Be Fun For EveryoneGetting My Lamina Loans To WorkGetting The Lamina Loans To WorkSome Of Lamina LoansSome Ideas on Lamina Loans You Need To Know

Lenders rely totally on your credit reliability, revenue level and quantity of present financial obligations when determining whether you're a good prospect. Since the danger is higher for the lending institution, APRs are additionally generally greater on unsafe financings (Lamina Loans).

In specific circumstances, the name or the function of the funding issues. The function of your loan can establish your rates and also even credit reliability in the eyes of lending institutions. As an example, some loan providers will provide various personal lending terms based on the funding's desired objective or use individual fundings for particular functions.

The Ultimate Guide To Lamina Loans

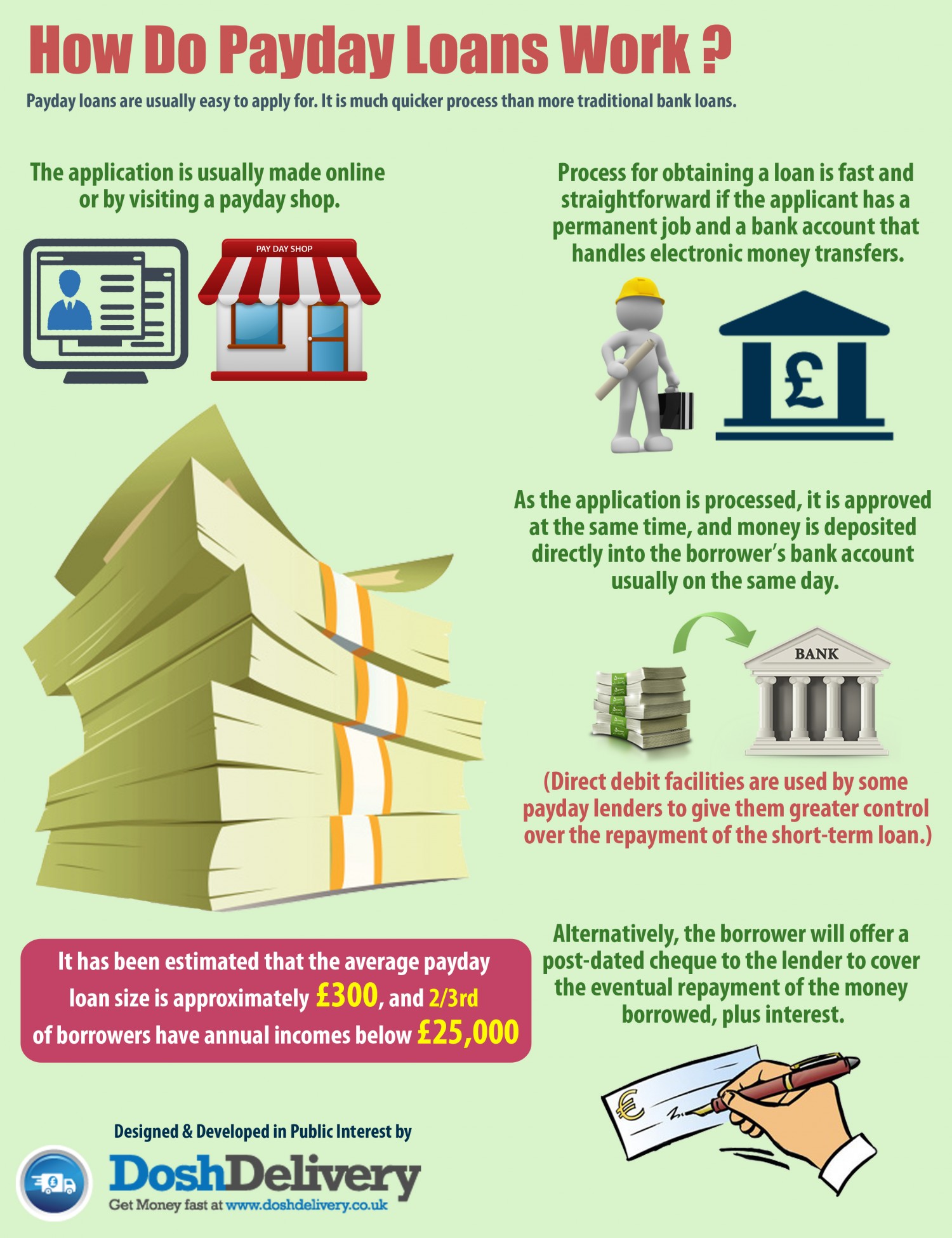

If you are accepted, the lending institution additionally appoints an interest rate to your financing. APRs also take costs right into account to offer you a far better sense of your funding's total price.Compute your approximated finance costs by utilizing this personal financing calculator. Input price quotes of the car loan quantity, rate of interest and loan term to get an idea of your prospective payment and overall costs for getting a personal funding. Your three-digit credit history plays a large function in your capacity to borrow cash and also score a positive rate of interest.

Prequalification is not a warranty that you'll be approved when you send an official application. After prequalifying with a couple of lenders, contrast your lending terms as well as each loan provider's charges usually, both interest rate as well as costs will certainly be shown in the APR. When you have actually discovered a lending institution you wish to deal with, it's time to move on.

What Does Lamina Loans Do?

Obtaining a lending isn't as difficult as it utilized to be, but you can not simply use for a finance anywhere. Your credit rating rating issues, and also a firm that lines up with your scenario is best.

Right here's everything you need to understand concerning finding and making an application for finances online. You can get numerous loan kinds online, but the most typical (and also usually most adaptable) option is the on the internet individual financing. The site majority of individual loans are unsecured, suggesting you do not need collateral, and also you can use them for practically any function.

What Does Lamina Loans Do?

: Fair, poor Yes: As quick as 1 business day: 0% 8%: $15 or 5% of payment: 36 or 60 months For added options, have a look at our choices for the best individual car loan lenders. Quick, convenient finance applications Same-day financing commonly readily available Flexible and can be used for financial debt loan consolidation, company costs, home renovations, and much more Lower prices than on-line cash advance loans Unsafe, so no collateral goes to danger Easy to contrast alternatives and also rates Bad-credit options readily available Rates might be more than a safeguarded finance, such as a home equity finance Rates might be more than with your personal bank or credit scores read review union Require due diligence (cash advance and also predacious lenders could impersonate personal funding lending institutions) The loans we've stated are online individual car loans, yet you need to watch out for payday advance.

On the internet fundings make comparison buying simple and also hassle-free. An APR of 5% on a $30,000 lending would indicate you would certainly pay regarding $1,500 in rate of interest yearly to borrow the cash.

Every loan provider charges different costs, such as source costs, late repayment charges, application costs, and more. Various other fees are not consisted of in the APR, such as late payment costs or early repayment penalties.

The Ultimate Guide To Lamina Loans

Make sure to get a complete malfunction of any type of costs you'll pay with each lender, so you can consider them in your decision. Contrast the total regards to each lending alternative. Longer settlement terms suggest reduced month-to-month settlements, however they additionally mean paying extra in passion in the future.On the internet car loans can provide you with the money you need to cover expenditures rapidly and also conveniently. Before you relocate forward with an online finance, however, make certain that the car loan is risk-free and the loan provider is reputable. Here are several of the pros as well as cons of on-line fundings. Safe on-line loans supply a selection of benefits consisting of: You can get an online car loan at any moment from the convenience of your own house.

When you are researching several on-line financings, you'll find it try this site easy to compare the offers you get. You'll be able to determine which finance is the finest choice for your individual budget, requires, as well as choices.

The Ultimate Guide To Lamina Loans

On the internet funding lenders typically supply pre-approvals. This suggests you can find out whether you're qualified for a finance with a soft credit report query. Unlike a difficult credit score inquiry, a soft credit rating query will have no effect on your credit. All credit history levels are qualified to use. Also if you have poor or reasonable credit scores, you might still get approved for fast secure finances online - Lamina Loans.Report this wiki page